How resilient is the Baltimore, MD housing market?

While the US residential housing market is recovering on a steady trajectory, the market still has not recovered to its pre-recession highs. The median home value in US is still only 86% of the nation's pre-recession high, and only 34% of homes have had their values surpass their pre-recession peak values, according to Trulia.

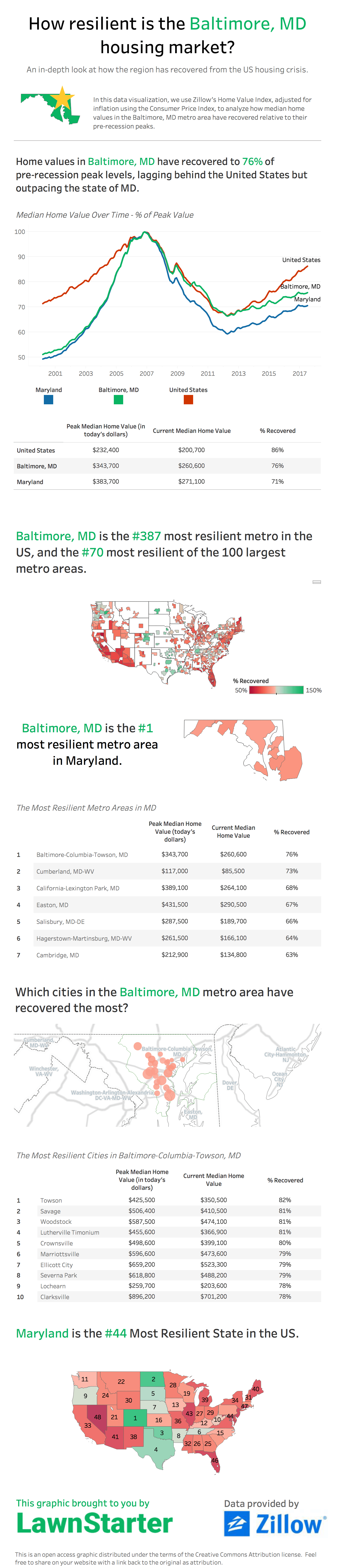

The Baltimore-Columbia-Towson, MD metro area follows the trend, only with median home values reaching only 76% of pre-recession peaks.

As a company providing lawn service to homes in Baltimore-Columbia-Towson, MD, it is in our best interest to fully understand and track all changes within the region's housing market. So we decided to publish some of our research so those interested can better understand the Baltimore-Columbia-Towson, MD housing market.

Methodology

We took historical data of Zillow's Housing Value Index - a measure for median home value - and adjusted the index for inflation using the Consumer Price Index (All Items Less Shelter), as recommended by the FHFA. We collected data at nationwide, state, metro and city levels.

From there, we compared current home values to their pre-recession peaks to understand how resilient the Baltimore-Columbia-Towson, MD area is relative to Maryland, the US, and other metro areas. We summarized the findings in an interactive data visualization, found at the bottom of the page.

Key Findings

- The median home value in Baltimore-Columbia-Towson, MD has reached $261k - 76% of the area's pre-recession peak of $344k.

- In terms of recovery, the region is behind the US and ahead of Maryland. Home values in these regions have reached 86% and 71% of peak values, respectively.

- Baltimore-Columbia-Towson ranks #70 among top 100 metro areas in the country in terms of recovery, and #387 across all metros.

- Of metro areas in Maryland, Baltimore-Columbia-Towson ranks #1 in terms of recovery.

Most Resilient Cities in the Baltimore-Columbia-Towson, MD Metro Area

- Towson

- Savage

- Woodstock

- Lutherville Timonium

- Crownsville

- Marriottsville

- Ellicott City

- Severna Park

- Lochearn

- Clarksville

Most Resilient Metros in MD

- Baltimore-Columbia-Towson, MD

- Cumberland, MD-WV

- California-Lexington Park, MD

- Easton, MD

- Salisbury, MD-DE

- Hagerstown-Martinsburg, MD-WV

- Cambridge, MD

Areas we service near Baltimore