Homeownership Rate in DC Area Drops to 20-Year Low

by John Egan

February 26, 2017

Is homeownership becoming less fashionable in Washington, DC? New numbers from the U.S. Census Bureau suggest it is.

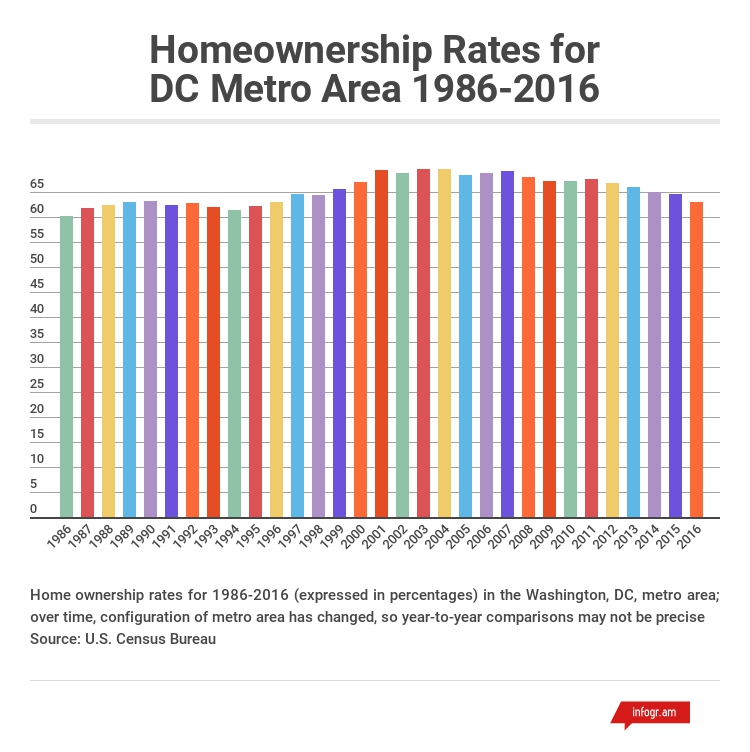

A LawnStarter analysis of Census Bureau data shows the DC metro area’s homeownership rate slipped to 63.1 percent in 2016 from 64.6 percent in 2015. That’s the lowest homeownership rate since 1996, when the rate also stood at 63.1 percent (the share of homes owned by their occupants). Put another way, the homeownership rate in the DC area is sitting at a 20-year low.

Dan Galloway, a Redfin real estate agent in the DC area, says a couple of factors are at work in driving down the homeownership rate in the region.

The first reason: Homeownership is out of reach for many people in the DC area.

“Prices have gotten so high in the DC metro region that at many price points, it is no longer cheaper on a per-month basis to buy than it is to rent unless you’re putting down quite a bit of money,” Galloway tells LawnStarter.

The second reason: Millennials have been slammed by student loan debt, meaning tight finances are making it tougher for them to buy a home.

“Student loan debt is now second only to the mortgage industry in terms of consumer debt load, and so that is an important consideration in looking at these trends,” Galloway says.

As such, more rental properties are being built these days in the DC area than new homes, according to Galloway.

The home market in the Washington, DC, area is “extremely competitive.”

Photo: Redfin

Still, he says, the DC area’s home-buying and home-selling market is “extremely competitive.”

“There are so many more people moving to the DC metro area than are leaving it that builders can’t keep pace with demand. Buyers continue to get fatigued on competition, so I can only guess that some continue to fall out of the market," Galloway says.

So, what lies ahead for homeownership in the DC area? Galloway isn’t too bullish about the future.

“If prices and the cost of living continue to outpace increases in salaries, we’ll see homeownership fall out of the hands of more and more buyers,” Galloway says. “To me, that’s a major issue -- the general cost of living and the specific cost of housing are rising faster than people can afford.”

Top Photo: Redfin

Related Posts

6 Common Weeds In The DC Area

How Valuable Are Pre-World War II Homes in the DC Area?

Proper Grass for your Northern Virginia Lawn

LawnStarter is Washington DC's most convenient lawn care service

Easy 5 minute booking

Washington DC's top-rated lawn pros

Online account management